A Term life insurance policy is your Plan B. Your fallback strategy if things don’t turn out the way you have planned. You don’t need me to tell you that life is uncertain. Living in the Twenty-first century is much more stressful than ever before. Our increasingly sedentary lifestyle and hectic work-life demands have increased the incidence of chronic illnesses. More and more people are dying of heart attacks due to stress related illnesses in their 30s and 40s than before.

To safeguard yourself and your family, which might be ill-prepared to handle the demands of day-to-day survival, you need to create a protective cover. The rising real-estate rates and exorbitant loans mean that in case of untimely demise, your family must bear the burden of liabilities and risk losing the roof over their heads. But you can protect your loved ones from these unforeseen difficulties by opting for Term Life Insurance.

What is Term Life Insurance?

Insurance is a vast jungle of unfamiliar terms and legal mumbo-jumbo. To simplify, let me start with explaining Term Life Insurance. Term Life Insurance is the type of insurance policy that helps you protect your family from the liabilities like loans and also provide for their day-to-day survival. You can get term life insurance quotes for both participatory and non-participatory term life insurance plans.

Participatory Term Life Insurance means that your premium is used by the insurance company to invest in other places. By participating in this investment, you get to share the profits from such investments. These payouts are separate from the fixed payments you are assured as part of the policy.

On the other hand, non-participatory Term Life Insurance policies do not have these dividends or surplus payments. You do not participate or agree to any additional investments and therefore get only fixed assured payments that are part of the policy.

Which Policy Do you Buy?

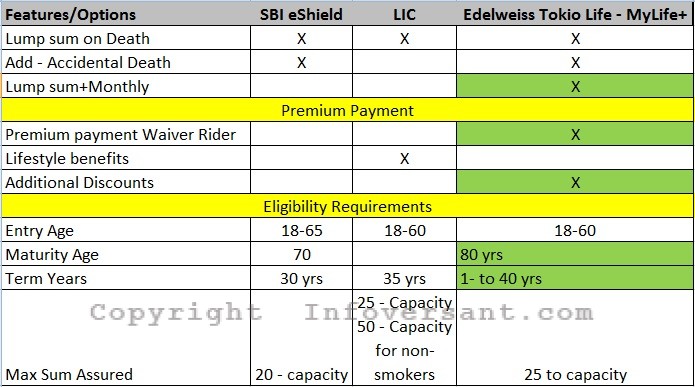

Even when you know these basic terms, buying an insurance policy can be tricky. I remember spending hours reading the fine print while buying my first policy. Term life insurance policy was still something new and I dived in to look at what is available. We usually gravitate toward PSU insurance companies like LIC or big banks like SBI when looking for something as crucial as an insurance policy. However, while reviewing various features, I found that Edelweiss term insurance, Edelweiss Tokio Life – MyLife+, has some advantages over these national companies.

Monthly Payout

Getting lump sum money is good. However, if your dependents aren’t financially savvy, wrong investment of this money can hamper a smooth flow of funds – that is what we are trying to protect, aren’t we?

Edelweiss Tokio Life – MyLife+ policy gives you the option to pay the sum assured in monthly payments. This way, your salary continues even when you are not here to take care of your family.

Payment Waiver Rider

This has to be the winner. Along with Edelweiss Tokio Life – MyLife+ term insurance, you can opt for a payment waiver rider. Death is a threat, but what we usually don’t imagine or think of is permanent disability – which is a bigger threat. What if an accident or a stroke restricts your ability to be physically fit and earn money? You not only don’t get any money during this time, but if you are unable to pay for your existing policy premiums, your family loses any possible benefits from the term insurance policy.

The option to buy Waiver of Premium rider allows you to safeguard your term insurance policy. This rider ensures that in case of debilitating accident or a severe heart attack, all future payments of the Term insurance policy are waived and its benefits protected.

Increased Age Limit

Life is a paradox. While lifestyle diseases have made us more prone to heart failures, advances in medicine have also increased our average lifespan. Edelweiss Tokio Life – MyLife+ term insurance policy is the only policy that provides you with the term maturity age of up to 80 years. It means that you can enter at a later date and will be protecting your spouse and kids that much longer.

Additional Discounts

You would think that more the cover, more would be the premium. But with Edelweiss Tokio Life – MyLife+ term insurance, you pay less for more. For example, for 25 lakh to 50 lakh sum assured, for the tenure of 25 years, you pay Rs. 190 per month. However, for the sum assured of 1 to 2 crore you pay just Rs 65 per month for the same tenure. Moreover, women get an additional discount as the company reduces their age for calculations by three years.

Consider your unique requirements while buying the term insurance policy. But comparing apples to apples, I believe that Edelweiss Tokio Life – MyLife+ term insurance policy clearly has some additional benefits over other life insurance companies that you must evaluate before making the final decision.

This is a sponsored post.

![]()

Leave a Reply